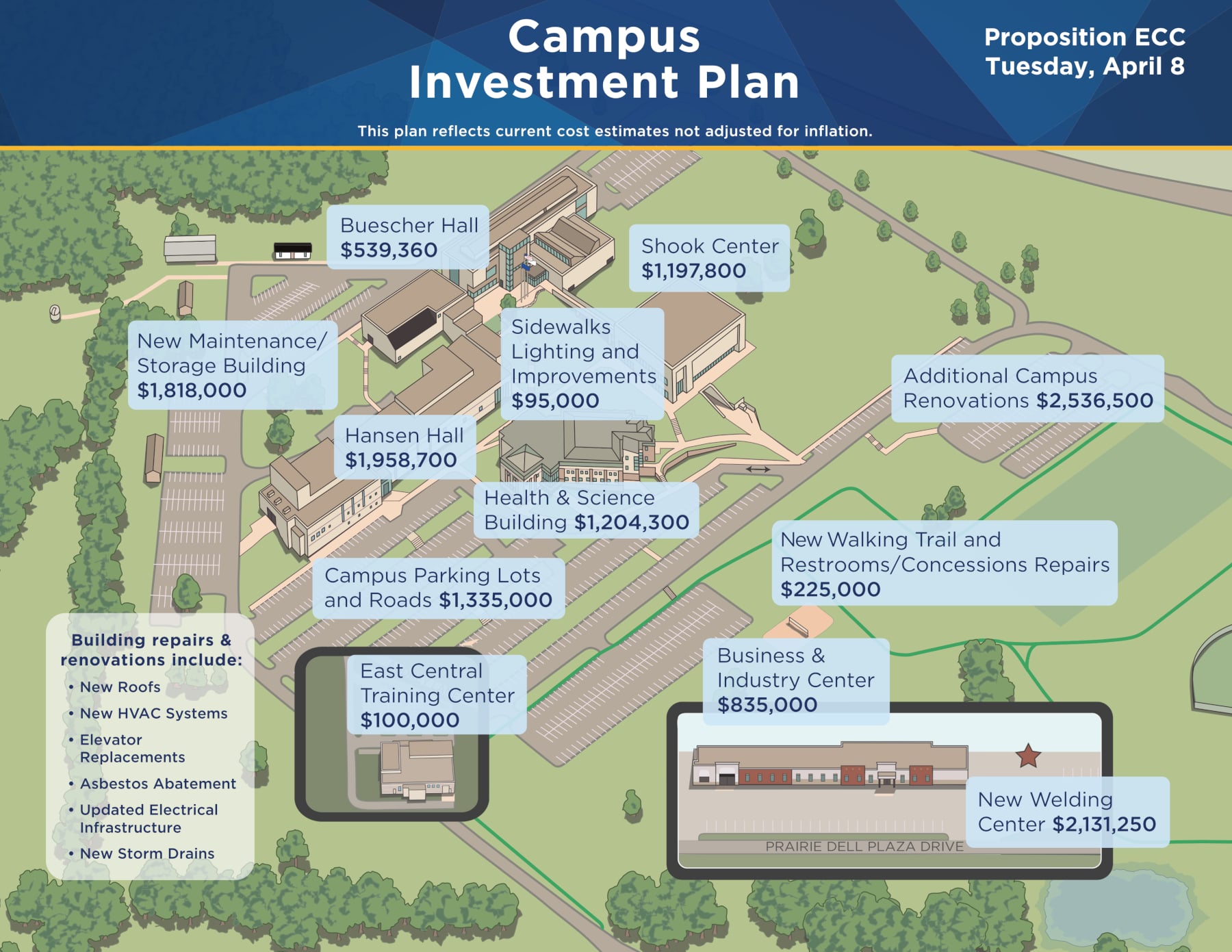

Proposition ECC is an April 8 ballot proposal to provide funding for the much-needed modernization and renovations of the six main buildings, grounds and infrastructure of the ECC Union campus, construct two new buildings to meet workforce and campus needs, as well as providing funds for increasing expenses of building utilities and health care.

A transfer of the current 9.9 cents in debt service to the operations levy will result in the current total local property tax levy of 44.72 cents remaining the same.

If Prop ECC is approved, the 9.9-cent debt service levy will be retired in early 2026, and the same 9.9 cents will be added to the operations levy.

If passed, Proposition ECC would:

- Provide funding to modernize and renovate the six main academic buildings on the ECC Union campus, two of the buildings were constructed in the 1970s and 1980s, and desperately need upgrades

- Repair and renew campus parking lots and streets

- Construct a new campus walking trail

- Construct a central storage facility, which provides the opportunity to repurpose underutilized space currently being used to store equipment and materials

- Construct a welding training facility to meet the growing needs for welding in the area’s workforce, which provides needed space for current Machining, HVAC and Industrial Maintenance programs to increase capacity

- Provide additional funds to operate the ECC Union campus, including the increasing cost of electricity, water, sewer and gas for the six main academic buildings and increasing health care costs.

The 9.9 cents transfer to the operating property tax levy equals:

- $18.81 per year for a $100,000 Valued Home

- $37.62 per year for a $200,000 Valued Home

- $56.43 per year for a $300,000 Valued Home

How will the $2.2 million from the transfer to the operations budget be used?

Building modernization and renovation, construction, and continued increases in campus operating expenses such as health care, utilities (electric, gas, water, and sewer) and routine maintenance.

Why can’t ECC ask the state of Missouri to increase its yearly state funding to cover the cost of the campus modernization, renovation, construction, and increases in operating expenses?

The College does receive yearly funding from the state of Missouri.

However, ECC received $400,000 LESS in 2025 from the state of Missouri than it did in 2002.

Building Modernization Breakdown:

- Building Roofs–$1,300,000

- Shook Student Center

- Hansen Hall

- Business & Industry Center (Manufacturing Programs)

- Building HVAC systems—$2,622,360

- Hansen Hall

- Buescher Hall

- Health Science

- Business & Industry Center (Manufacturing Programs)

- Campus Roads and Parking Lots—$1,812,470

- Additional Building Renovations – $2,536,000

- Asbestos abatement (Shook Student Center)

- Elevator replacements

- Restrooms upgrades

- Sewer line replacements

- New campus fitness trail

- Enhanced campus lighting and security cameras

- Renovate reclaimed campus space

New Construction

Welding Training Facility: $2,131,250

A 7,000 square foot welding training facility to provide opportunities for expansion of current welding programming and provide additional space for current HVAC, Precision Machining, and Industrial Maintenance programs to expand or create new manufacturing programs.

Campus Storage Facility: $1,818,000

A 10,000 square foot campus storage facility, that provides a centralized location, which frees up space for current underutilized space for additional classrooms, labs and workforce training spaces.

Total Current Cost of Campus Projects: $12.2 Million

Expected Future Cost: $15 Million (Due to inflation and expected increase in construction costs)

What happens if Proposition ECC isn’t approved by voters?

The need to repair and enhance the college campus isn’t going away. If the levy transfer isn’t approved, the College will need to use the current operating budget to fund the projects.

The impact causes spending in other areas to be reduced, with a detrimental effect on programs and services that are needed by students, employees, and the community.

How will increasing the permanent operating levy stabilize and enhance the future of East Central College?

- Financial Stability & Predictability – A permanent tax ensures a steady revenue stream for essential services for campus infrastructure and safety.

- Long-Term Investments – Permanent operating revenue helps ECC make strategic decisions and investments with confidence, compare to facing uncertainty regarding future funding.

- Public Trust & Accountability – East Central College has an impeccable checks and balances system with strong transparency measures and public reporting. The six-member, citizen elected board of trustees ensures all college funds will continue to be used responsibly and effectively without the need for a sunset clause.

How does Proposition ECC impact those without a direct connection to ECC?

Economic Impact of East Central College on the ECC Taxing District

An independent study was conducted by Idaho-based Lightcast in fall 2024, using objective third-party data to demonstrate the economic and social benefits of East Central College to the region.

Economic impact analysis

In FY 2022-23, ECC added $110.9 million in income to the ECC Taxing District* economy, a value approximately equal to 2.7% of the region’s total gross regional product (GRP). Expressed in terms of jobs, ECC’s impact supported 1,891 jobs.

For perspective, the activities of ECC and its students support one out of every 26 jobs in the ECC Taxing District.

Summary of Investment Analysis Results

Student perspective

Taxpayer perspective

Social perspective

For more information about the economic impact report, explore our Economic Impact page.

Will the in-district operating levy be used to construct the new Rolla facility?

NO. The College currently has $16.5 million in state dollars and $3 million in federal dollars for the building renovation project. Additional state, federal and grant dollars will be used to construct the facility. It is expected to be completed in January 2027.

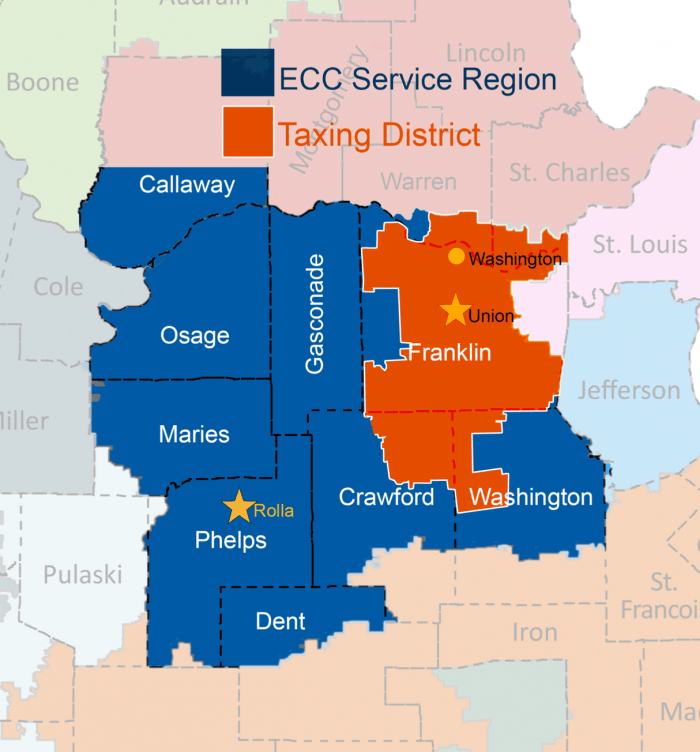

Who is eligible to vote in the April 8 ballot?

Citizens who reside in one of the following school districts:

K–12 Districts

- Crawford County R-1 (Bourbon)

- New Haven

- St. Clair R-13

- Sullivan C-2

- Union R-11

- Washington

K–8 Districts

- Franklin County R-2

- Lonedell R-14

- Spring Bluff R-15

- Strain-Japan R-16

This taxing district includes most of Franklin County and portions of Crawford, Gasconade, St. Charles, Warren, and Washington Counties.

Residents living in the ECC service region (in blue) don’t pay taxes to the College, but students from those areas attending East Central College pay 30 to 50% in a higher tuition rate for attendance.

Endorsements

- Downtown Washington, Inc.

- Union Development Corporation

- Washington 353 Economic Development

- Bourbon Economic Development Group, Inc.

- Washington Area Chamber of Commerce

- Franklin County Labor Club

We want to talk to you!

If you know of a community group or organization interested in having a College employee present “Proposition ECC” information to its members, contact ECC president Dr. Jon Bauer.

Questions?

Contact Dr. Jon Bauer – jon.bauer@eastcentral.edu or 636-584-6501

Official Ballot Language

Shall the Board of Trustees of The Junior College District of East Central Missouri (aka East Central College) be authorized to maintain the current total property tax levy by increasing the operating property tax levy ceiling to $0.4472 per one hundred dollars of assessed valuation, the increase of $0.0990 from the current operating property tax levy of $0.3482 is to be offset by a $0.0990 decrease in the debt service property tax levy, for the purpose of funding construction, maintenance and repairs, operating expenses, personnel and safety/security measures within the College District.

Approval of this question will result in zero increase of the College District’s current total property tax levy, which is estimated to remain unchanged at $0.4472 per one hundred dollars of assessed valuation.